Contents

The decentralized nature of forex markets means that it is less accountable to regulation than other financial markets. The extent and nature of regulation in forex markets depend on the jurisdiction of trading. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forwards markets, which are decentralized and exist within the interbank system throughout the world. In the United States, the National Futures Association regulates the futures market.

The difference between these two amounts, and the value trades ultimately will get executed at, is the bid-ask spread. Any news and economic reports which back this up will in turn see traders want to buy that country’s currency. On the forex market, trades in currencies are often worth millions, so small bid-ask price differences (i.e. several pips) can soon add up to a significant profit. Of course, such large trading volumes mean a small spread can also equate to significant losses. Forex trading is the process of speculating on currency prices to potentially make a profit.

The forex market is more decentralized than traditional stock or bond markets. There is no centralized exchange that dominates currency trade operations, and the potential for manipulation—through insider information about a company or stock—is lower. Forex trading generally follows the same rules as regular trading and requires much less initial capital; therefore, it is easier to start trading forex compared to stocks. The extensive use of leverage in forex trading means that you can start with little capital and multiply your profits. Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50. If the investor had shorted the AUD and went long on the USD, then they would have profited from the change in value.

Prior to the First World War, there was a much more limited control of international trade. Motivated by the onset of war, countries abandoned the gold standard monetary system. The use of leverage to enhance profit and loss margins and with respect to account size. We offer commission-free trading with no hidden fees or complicated pricing structures.

People who use technical analysis are focused on things like momentum, trend, and of course, support and resistance. There is a multitude of indicators and candlestick patterns that traders will use to determine potential moves as well. These are instruments that allow traders to benefit from price fluctuation in an instrument without actually owning it outright.

For today’s Forex traders, this means that they need no longer feel Forex-deprived because of short balances, or lack of access to the global exchange market. The most common type of forward transaction is the foreign exchange swap. In a swap, two parties exchange currencies for a certain length of time and agree to reverse the transaction at a later date. These are not standardized contracts and are not traded through an exchange. A deposit is often required in order to hold the position open until the transaction is completed.

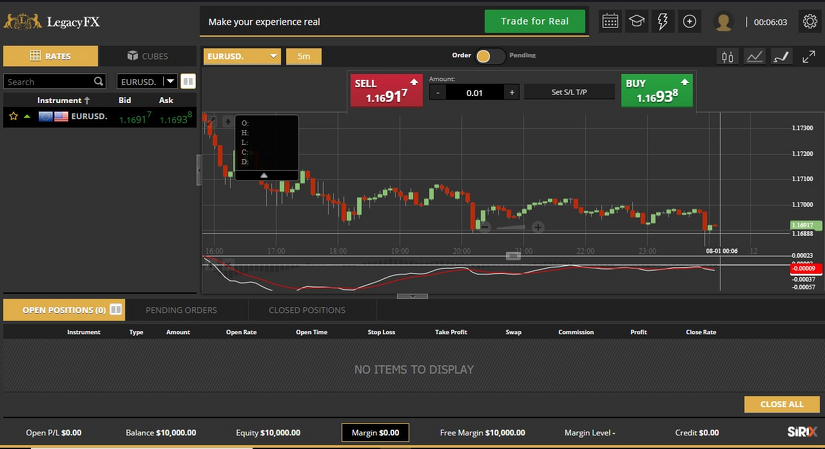

Comprehensive software solutions for brokerages, digital asset platforms and prop trading companies. Our mission is to keep pace with global market demands and approach our clients’ investment goals with an open mind. In addition our range of platforms for Apple and Android mobile devices will seamlessly allow you to access and trade on your account from your smartphone or tablet with full account functionality. By opening a demo account at RoboForex, you can test our trading conditions – instruments, spreads, swaps, execution speed – without investing real money. The choice of experienced traders, which combines the highest order execution speed and competitive trading conditions. It provides balanced conditions for efficient trading on the currency and other types of markets.

Basic Forex Trading Strategies

The combined resources of the market can easily overwhelm any central bank. Several scenarios of this nature were seen in the 1992–93 European Exchange Rate Mechanism collapse, and in more recent times in Asia. At the end of 1913, nearly half of the world’s foreign exchange was conducted using the pound sterling.

Building a trading plan is crucial so that you are not simply guessing where the market is going to go. This is the difference between being a professional trader, and a gambler. If you choose to simply guess where things are going, you do have the possibility of being profitable occasionally, but the longer-term success is highly questionable. Free MT4 indicators Become our client and get our unique Purple indicators for free. Tackle down the pitfalls of technical analysis like a true professional.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.67.30% of retail investors lose their capital when trading CFDs with this provider. Risk aversion is a kind of trading behavior exhibited by the foreign exchange market when a potentially adverse event happens that may affect market conditions.

Leading european broker in profitability

Residents of other countries can continue to use all other services of the Bank and will be timely informed on developments of the Bank’s card program. Please beware of trading breaks for CFD’s and Bullion on US Memorial day, Monday 30th May. The US will celebrate Juneteenth National Independence Day on Monday, June 20th.

For this right, a premium is paid to the broker, which will vary depending on the number of contracts purchased. A pip is the smallest price increment tabulated by currency markets to establish the price of a currency pair. A spot exchange rate is the rate for a foreign exchange transaction for immediate delivery. Prior to the 2008 financial crisis, it was very common to short the Japanese yen and buyBritish pounds because the interest rate differential was very large.

So long as you start currency trading with a reputable Forex broker, you won’t have to roleplay as one of Jordan Belfort’s victims. While it’s always possible to lose money when trading, the best Forex brokers offer a degree of protection against losing money rapidly. The first thing you will have to do is understand how the currency markets https://en.forexpamm.info/ operate. This is much different than most markets that you may be used to, such as futures or stock markets. This is because both futures and stock markets are centrally controlled, via an exchange. An award winning and leading provider of online foreign exchange trading, stocks, CFD trading, Crypto and related services worldwide.

Established in 1974, IG was founded as the first legitimate spread betting firm. Since then, they’ve acquired nearly 200,000 clients and have grown to list CFDs across tens of thousands of financial markets. Experienced retail investors can buy, sell, or trade across 17,000+ fee-free mutual funds. Remember that the price per point of a standard lot in the GBP/USD pair is worth $10, so it is simply a matter of multiplying the distance traveled in points by the worth of each contract. It is also worth noting that not every trade will be a full contract, so therefore the calculation needs to pay special attention to the position size.

How Do I Get Started With Forex Trading?

Economic data is integral to the price movements of currencies for two reasons – it gives an indication of how an economy is performing, and it offers insight into what its central bank might do next. Supply is controlled by central banks, who can announce measures that will have a significant effect on their currency’s price. Quantitative easing, for instance, involves free download pivot point indicator injecting more money into an economy, and can cause its currency’s price to drop. A base currency is the first currency listed in a forex pair, while the second currency is called the quote currency. A contract that grants the holder the right, but not the obligation, to buy or sell currency at a specified exchange rate during a particular period of time.

But it has become more retail-oriented in recent years, and traders and investors of many holding sizes have begun participating in it. None of the blogs or other sources of information is to be considered as constituting a track record. Any news, opinions, research, data, or other information contained within this website is provided as general market commentary and does not constitute investment or trading advice. FOREXLIVE™ expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information.

What Moves the Forex Market

Although their offices are closed on weekends; you’ll have access to fast, highly qualified agents on a 24/5 basis. You’ll also have the ability to buy, sell, or trade BTC, ETH, LTC, and Ripple in fractional increments. To withdraw your cash, you’ll need to pay a minimal $10 surcharge for bank wire transfers. Although Interactive Brokers’ website and mobile apps can take some time to adjust to; we were impressed by their site’s unique investment categorizations. However, there is a list of countries that aren’t allowed to trade at PrimeXBT, due to local regulations.

Market Research Products

An opportunity exists to profit from changes that may increase or reduce one currency’s value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen because currencies are traded as pairs. In addition to forwards and futures, options contracts are also traded on certain currency pairs. Forex options give holders the right, but not the obligation, to enter into a forex trade at a future date and for a pre-set exchange rate, before the option expires.

LEADING MARKET DATA & RESOURCES

During the 15th century, the Medici family were required to open banks at foreign locations in order to exchange currencies to act on behalf of textile merchants. In 1704, foreign exchange took place between agents acting in the interests of the Kingdom of England and the County of Holland. Forex trading exposes you to risk including, but not limited to, market volatility, volume, congestion, and system or component failures, which may delay account access and/or Forex trade executions.

The tourist has to exchange the euros for the local currency, in this case the Egyptian pound, at the current exchange rate. Gordon Scott has been an active investor and technical analyst of securities, futures, forex, and penny stocks for 20+ years. He is a member of the Investopedia Financial Review Board and the co-author of Investing to Win. EToro doesn’t charge any fees related to stock or ETF transactions, and their 1% crypto transaction fee is the lowest we’ve found among regulated broker sites. Although XTB charges a $10 monthly fee after one year of inactivity has elapsed, they offer fee-free bank wire payouts and a $0 minimum deposit requirement to start trading. Once you’re able to get past this hurdle; you’ll enjoy fee-free crypto purchases and minimal stock trading commissions.

In addition to technical analysis, swing traders should be able to gauge economic and political developments and their impact on currency movement. Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The currency forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets to hedge against future exchange rate fluctuations, but speculators take part in these markets as well.

Our risk-free demo account also allows you to practice these skills in your own time. Like with any type of trading, financial market trading involves buying and selling an asset in order to make a profit. As a forex trader, you’ll notice that the bid price is always higher than the ask price. FXTM offers a number of different trading accounts, each providing services and features tailored to a clients’ individual trading objectives.

If the U.S. dollar fell in value, then the more favorable exchange rate would increase the profit from the sale of blenders, which offsets the losses in the trade. To accomplish this, a trader can buy or sell currencies in the forwardor swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in Europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity. For example, EUR/USD is a currency pair for trading the euro against the U.S. dollar. Because we believe that active traders should have a world of options at their fingertips, we prioritized foreign exchange platforms that give investors the broadest range of markets to choose from. With 80+ currency pairs in addition to gold and silver options, Forex.com has earned their prominence as the #1 Forex brokerage for US traders.

This is why currencies tend to reflect the reported economic health of the region they represent. Automation of forex markets lends itself well to rapid execution of trading strategies. Forex markets exist as spot markets as well as derivatives markets, offering forwards, futures, options, and currency swaps.

Multinational businesses use it to hedge against future exchange rate fluctuations to prevent unexpected drastic shifts in business costs. Individual investors also get involved in the marketplace with currency speculation to improve their own financial situation. Currency speculation is considered a highly suspect activity in many countries.[where? For example, in 1992, currency speculation forced Sweden’s central bank, the Riksbank, to raise interest rates for a few days to 500% per annum, and later to devalue the krona. Mahathir Mohamad, one of the former Prime Ministers of Malaysia, is one well-known proponent of this view. He blamed the devaluation of the Malaysian ringgit in 1997 on George Soros and other speculators.

PrimeXBT Trading Services LLC is incorporated in St. Vincent and the Grenadines as an operating subsidiary within the PrimeXBT group of companies. PrimeXBT Trading Services LLC is not required to hold any financial services license or authorization in St. Vincent and the Grenadines to offer its products and services. For your first trade, you identify potential setups and then decide whether you are going to buy or sell a currency pair. Once you press the “buy” or “sell” button, your position is in the market.

Security of Client’s Funds

Forex brokers acts very much like CFD brokers, with the exception that they do not offer other instruments. You are still betting on the price movement of a currency pair, and you are still not taking delivery of the underlying currencies involved. However, if you are looking for more opportunities, a CFD broker like PrimeXBT is the way to go. To excel in a forex trading career, you will need to be comfortable in a high-stakes environment and prepared to handle appropriate levels of risk in your trading. With large amounts of capital and assets on the line, having a calm and steady demeanor in the face of ebbs and flows in currency markets can be helpful. So, whether you’re new to online trading or you’re an experienced investor, FXCM has customisable account types and services for all levels of retail traders.

Clocks will be advanced by 1 hour this Sunday, 27th of March in many European countries. The Bank’s net profit for the first four months of 2022 was CHF 3.5 million. For the first four months of 2022, total income from ordinary banking operations increased by 25.4% compared to 2021 and operating expenses decreased by 4.7% compared ibfx australia to the same period of 2021. For any questions regarding the use of Tether, P2P marketplace, or other services, please contact the Dukascopy Bank’s Support team. Please beware of reduced liquidity and special trading breaks for CFD’s and Bullion on Monday 4th of July 2022 due to Independence Day celebrations in the US.

Money transfer companies/remittance companies perform high-volume low-value transfers generally by economic migrants back to their home country. In 2007, the Aite Group estimated that there were $369 billion of remittances (an increase of 8% on the previous year). The largest and best-known provider is Western Union with 345,000 agents globally, followed by UAE Exchange. Bureaux de change or currency transfer companies provide low-value foreign exchange services for travelers.

Trading forex is risky, so always trade carefully and implement risk management tools and techniques. A spot trade is the purchase or sale of a foreign currency or commodity for immediate delivery. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia requires writers to use primary sources to support their work.