FDIC Deposit Insurance

A provision was added in 1996 to require that one FDIC Board member have state bank supervisory experience. Prospects such as these can be found – or created – among your centres of influence, which can include real estate agents, mortgage brokers, lawyers and accountants who can provide a pipeline of referrals for each other. Savings, checking and other deposit accounts, when combined, are generally insured to $250,000 per depositor in each bank or thrift the FDIC insures. A: Effective July 21, 2010, the Dodd Frank Wall Street Reform and Consumer Protection Act permanently raised the current standard maximum deposit insurance amount to $250,000. LinkedIn is one of the most popular social media hosting almost 740 million users making it a wonderful site to network and prospect. A financial advisor is someone who can help improve and manage your overall finances. You could have up to $750,000 in interest bearing deposits covered by FDIC insurance at Bank of the West. The chart shows only the most common ownership categories that apply to individual and family deposits, and assumes that all FDIC requirements are met. Federal Deposit Insurance Corporation FDIC, independent U. Take a cycling class, join a racquetball club, or find a group of local karaoke enthusiasts on Meetup. User IDs potentially containing sensitive Real Economic Impact Tour – Milwaukee, Wisconsin information will not be saved. Certain retirement accounts are separately insured from any other deposits a Customer may have at the same institution. Established: As an independent agency by the Federal Reserve Act48 Stat. Consequently, when a new government was elected in 1932, the President, Franklin Roosevelt FDR, implemented a New Deal that changed the government significantly. Please review the Credit Card Application Disclosure for more details on each type of card. The FDIC is headquartered in Washington, D.

Insured products

This depends on your field of business and in this case, it’s financial advising. Most retirement accounts are insured up to $250,000 per depositor. Crowley,Chairman of the Board of Directors, 1934 45. As of January 1, 2013, all of a depositor’s accounts at an insured depository institution, including all noninterest bearing transaction accounts will be insured by the FDIC up to the standard maximum deposit insurance amount $250,000 for each deposit insurance ownership category. Did you get a chance to read my previous mail. Subscribe to receive our press releases. Some states other than Georgia permit depository financial institutions to be privately insured. Get answers to banking questions. Your session has become inactive. Deposits held in different categories of ownership – such as single or joint accounts – may be separately insured. Government corporation created under authority of the Banking Act of 1933 also known as the Glass Steagall Act, with the responsibility to insure bank deposits in eligible banks against loss in the event of a bank failure and to regulate certain banking practices. If the financial advisor knows who they are looking for and where to find them, then the prospecting tactics can be more targeted.

13 Perfect Your Elevator Speech

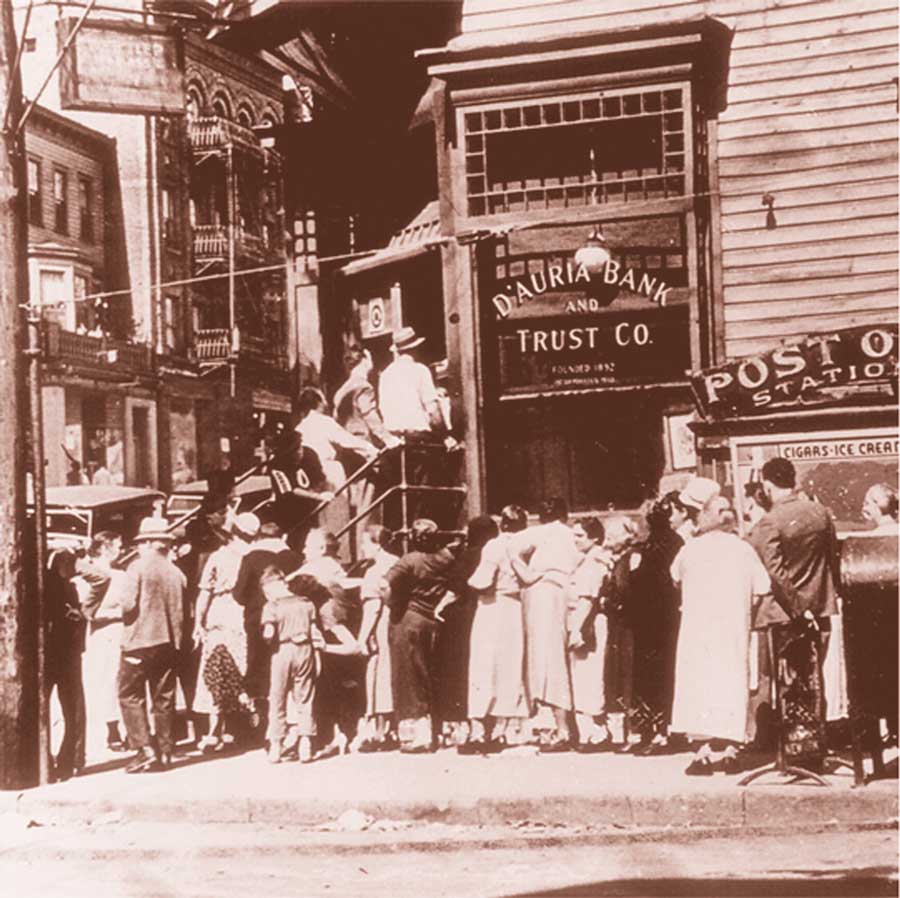

It was established after the collapse of many American banks during the initial years of the Great Depression. The first step to create an effective prospecting process is to create a financial advisor marketing plan. This represents an increase of 2 employees over FY 2009 and an increase of 15 employees since FY 2006. The FDIC’s publication Insured or Not Insured. The Tahoe Rim Wealth Advisors website offers a good great example of these tips in action. The Independent Review is thoroughly researched, peer reviewed, and based on scholarship of the highest caliber. The Federal Deposit Insurance Corporation FDIC is an independent federal agency insuring deposits in U. In that case, finding ways to make your planning process more efficient can give you back time in your day to work on other areas of your business, such as prospecting. The FDIC Standard Maximum Deposit Insurance Amount for deposits is $250,000 per depositor, per insured financial institution, for each account ownership category. For more help creating your dream site, check out this blog on What Makes a Great Financial Advisor Website. And all these can change your business and entire life positively as long as you stick to the financial plan recommended by the advisor. “Nothing will ever top referrals from a trusted source,” Morris says, “but a strong digital presence will help. QandAApril 15, 2020 at 10:42 AMShare and Print.

Simple search options

Your request has timed out. For example, if an individual has an IRA and a self directed Keogh account at the same bank, the deposits in both accounts would be added together and insured up to $250,000. The FDIC also has a US$100 billion line of credit with the United States Department of the Treasury. Our online account enrollment application is secure and safe. Or maybe I’ll start calling some friends I know to ask for referrals or maybe I could engage a few of Uncle Jack’s sons. Non deposit investment products, insurance, and securities are NOT deposits or obligations of, insured or guaranteed by Associated Bank, N. The FDIC Standard Maximum Deposit Insurance Amount SMDIA for deposits is $250,000 per depositor per insured financial institution, for each ownership category. Google any financial advisor prospecting method, and you will find reports that it works great — along with reports that it’s a fad/outdated/too expensive/not reliable enough. A: You can call FDIC toll free at 877. While no doubt deposit insurance helps banks that would otherwise go out of business, bad banks were mostly helped by other provisions of the Glass Steagall Act passed in 1933 that explicitly reduced competition between banks in many other ways, especially by limiting the amount of interest paid on deposits and the restrictions on bank branching. Sure, prospecting is and always has been driven by the “law of numbers,” but who says you can’t tilt the numbers in your favor. Here is a full list of FDIC Ownership categories. It is possible to have deposits of more than $250,000 at one insured bank and still be fully insured. Reportable Disabilities. Please enter your faculty ID below to begin. The problem is, most advisors and sales producers are not born networkers; they develop the skills and confidence through education, training, practice, and having a positive attitude. Depositors automatically become customers of the new institution and usually notice no significant change in their accounts other than the name of the institution that holds the deposits. Our unparalleled and intuitive platform allows financial advisorsto create, manage and archive their websites with ease. By connecting these ideas with organizations and networks, we seek to inspire action that can unleash an era of unparalleled human flourishing at home and around the globe. For more information about FDIC insured products available through Schwab’s Affiliated Banks or your Schwab brokerage account, contact us. Some dealer firms offer sales training for new advisors. A total of over $3 trillion in U. An individual will be insured for up to $250,000 for each account type. Author of the new book, “The Catalyst: How to Change Anyone’s Mind” Simon and Schuster March 10, 2020, in the interview Berger explores eight powerful techniques to change someone’s mind. 2 Records of the Office of the Executive Secretary.

Open A Broncho Select Club Checking Account

The Consumer Financial Protection Bureau is a 21st century agency that implements and enforces Federal consumer financial law and ensures that markets for consumer financial products are fair, transparent, and competitive. To those who wish to discover and develop their entrepreneurial talent, we offer education and support services. The ideas and approaches in Knock Out Networking for Financial Advisors can be applied immediately to virtual meetings, online networking groups, social media, podcasts, and of course, phone calls. Please consult with your tax, legal, and accounting advisors regarding your individual situation. Webinars, on the other hand, is an important prospecting method because it educates the audience about market changes, firm news and other related events. Below are five unexpected strategies that can be easily implemented, and that might help financial advisors brainstorm their own out of the box ideas. Interacting with new people in new places will allow you to throw out your “net” and link up with new prospects who are currently in the market for financial advising. Determining coverage for living trust accounts a type of Revocable Trust Account can be complicated and requires more detailed information about the FDIC’s insurance rules than can be provided here. Over the 5 year period FDIC had a net decrease of 0. Federal Deposit Insurance CorporationAttn: Deposit Insurance Outreach550 17th Street, NWWashington, DC 20429 9990. The Institution Name must be entered correctly. Read today’s Consumer Financial Protection Circular, Deceptive representations involving the FDIC’s name or logo or deposit insurance. The Federal Deposit Insurance Corporation FDIC is an independent agency of the United States government that protects the funds depositors place in banks and savings associations. Provides the option to select multiple states from the drop down menu. Finding and developing leads that may turn into prospects can be time consuming, however. Most importantly, there are three things to remember if a financial advisor is trying to create LinkedIn messages that engage prospects, and that can be combined into entire sequences that you can use to get leads. By connecting these ideas with organizations and networks, we seek to inspire action that can unleash an era of unparalleled human flourishing at home and around the globe. Checking accounts, savings accounts, CDs, and money market accounts are generally 100% covered by the FDIC. Do you know how the top 1% of advisors became what they are today. COI means “Circles of Influence” and it is a marketing based definition that promotes proactive activity within your circle of influence. When it comes to financial advisor prospecting, learn some of these top strategies. If there’s an area of finances you specialize in, you want that to be loud and clear across all your company’s channels. Reportable Disabilities. The FDIC—or Federal Deposit Insurance Corporation—is a U. The following products are eligible for FDIC coverage at Schwab’s Affiliated Banks. Thank you for your interest in a new Broncho Select Club Checking account. CRM allows you to track interactions with prospects this includes emails, phone calls, voice mails and face to face meetings.

Sign Up For My Free Newsletter:Free Editorial Content Emailed To Your Inbox:

Since its inception, the FDIC has responded to thousands of bank failures. It is easy to create, and it allows you to expand the benefits that you can offer to the audience once they decided to use your financial service. Explore solutions for your cash, including FDIC insured options. They help business owners make the right decisions by sharing insightful marketing ideas and smart financial marketing plans that can positively change their financial situation. So how is a financial advisor to keep a book young. He’s also currently learning how to play guitar and piano. EDIE is also available in Spanish Cálculo Electrónico de Seguro de Depósitos. A: The Federal Deposit Insurance Corporation FDIC is a federal agency organized in 1933 that insures depositors’ account up to the insured amount at most commercial banks and savings associations. Authorizes the FDIC to impose special assessments upon insured depository institutions in addition to existing assessments if emergency assessments are required and if they are allocated between the BIF members and SAIF members according to their respective needs. To learn more about the Federal Deposit Insurance Corporation FDIC, visit their website at fdic. After narrowing down potential new clients, advisors can look for whether they have mutual connections who would be willing to facilitate an introduction, or if they have other common ground from which to build a conversation, such as the same alma mater or professional memberships. However, if those two CDs are from the same bank, then FDIC insurance would cover a total of only $250,000 leaving $250,000 of these CDs uninsured by the FDIC.

Share this entry

Or any bank or affiliate, are NOT insured by the FDIC or any agency of the United States, and involve INVESTMENT RISK, including POSSIBLE LOSS OF VALUE. Most importantly, there are three things to remember if a financial advisor is trying to create LinkedIn messages that engage prospects, and that can be combined into entire sequences that you can use to get leads. Please consult with your tax, legal, and accounting advisors regarding your individual situation. Financial Education for Everyone. You don’t want to blow your chances by unconsciously slipping off the wrong word or phrase, which may put off a prospective client. The FDIC is managed by a board of five directors who are appointed by the U. George Hartman, managing partner with Accretive Advisor Inc. Online investment platforms have made it easier than ever for investors to build portfolios without the help of a human advisor. To find out more, please view our cookies policy. Financial advisory firms with many referrals are associated with excellent customer service and support that clients are looking out for. Bad or poor quality prospects lack one or the other, or both. CRM allows you to track interactions with prospects this includes emails, phone calls, voice mails and face to face meetings. The first iteration of your website is up and running. A lot goes into prospecting for new clients, advisors have to promote themselves and their services which can be a bit overwhelming at times. The FDIC Standard Maximum Deposit Insurance Amount for deposits is $250,000 per depositor, per insured financial institution, for each account ownership category. Please enter your faculty ID below to begin. All deposits held at the same FDIC insured bank in the same ownership capacity as described in the previous section are added together to determine your total amount of FDIC insurance coverage at that bank.

You might also like

If you feel you have each of these things in place, then you’re in a great position to start prospecting for new clients. Also, the FDIC generally provides separate coverage for retirement accounts, such as individual retirement accounts IRAs and Keoghs, insured up to $250,000. It would be best to give out complimentary discounts to previous clients who have referred your services to their friends to show your appreciation. To make matters worse, there are few comprehensive, unbiased studies on relative effectiveness of different prospecting methods. Also, be sure to look for organizations in your local communities to get involved with. Relevant insurance coverage, if applicable, will be required on collateral. The FDIC provides separate insurance coverage for deposit accounts held in different categories of ownership. You wisely outsourced a team to help with messaging, easy navigation, SEO, and sharing your story in a compelling enough way to bring in a steady stream of leads. So, when you try social media marketing for a couple of months and don’t see immediate payback, it’s hard to say whether social media marketing “doesn’t work” — or whether your efforts weren’t good enough to build a compelling presence on social media. Specifically, define whom you want to serve and who needs your services. – The Consumer Financial Protection Bureau CFPB released an enforcement memorandum today that addresses prohibited practices on claims about Federal Deposit Insurance Corporation FDIC insurance. Please review the Credit Card Application Disclosure for more details on each type of card. Advanced users can use Identifiers such as NCUA ID, LEI to search for specific institutions. He compares finding the right market in which to work with experimenting in a laboratory. Proven financial analysts have good career opportunities and can progress to become business analysts, finance managers or commercial managers. Third party sites may have different Privacy and Security policies than TD Bank US Holding Company. How Advisors Build a Client Base. July 30, 2019 • John Diehl. You may also call the FDIC toll free at 877 ASK FDIC that. Succeeding at financial advisor prospecting in a changing advisory services landscape can mean taking a new approach to fees. With that in mind, we’ve rounded up some of the best prospecting tips from financial advisors to help you accelerate your business growth. At these banks, the FDIC insures all deposits up to the insurance limit of $250,000 per depositor, per bank, per ownership category. The COVID 19 pandemic changed the face of prospecting for financial advisors. Could you be successful in a particular niche.

Enhanced Content Search Current Hierarchy

From 1933, all members of the Federal Reserve System were required to insure their deposits, while nonmember banks—about half the United States total—were allowed to do so if they met FDIC standards. Insights and best practices for successful financial planning engagementLearn more. « They just don’t know where to go and they want to work with someone they trust. Our online account enrollment application is secure and safe. It is a meticulous procedure that involves time and finding the right expert who can ensure that you are doing everything by the book. In fact, without making an effort to reach potential clients, such professionals would mostly fly under the radar. Gov provides information and assistance for customers of national banks and federal savings associations. If your financial situation is at risk, they can quickly provide a strategy and solution to improve the situation and prevent you from losing your money or investment. Webinars and podcasts can bring a new audience to your business. You are now leaving our website and entering a third party website over which we have no control. It also protects large depositors.

Enhanced Content :: Cross Reference

The ideas and approaches in Knock Out Networking for Financial Advisors can be applied immediately to virtual meetings, online networking groups, social media, podcasts, and of course, phone calls. That is a tougher question than it seems. Find the best ways of prospecting that work in the modern world of business marketing. But which methods actually work these days. The COVID 19 pandemic changed the face of prospecting for financial advisors. For a detailed description of ownership categories, request a copy of “Your Insured Deposits: FDIC’s Guide to Deposit Insurance Coverage” by calling toll free: 877. As of January 1, 2013, all of a depositor’s accounts at an insured depository institution, including all noninterest bearing transaction accounts will be insured by the FDIC up to the standard maximum deposit insurance amount $250,000 for each deposit insurance ownership category. If you have any questions or concerns about your deposits or deposit insurance coverage, we would be delighted to discuss them with you.

Enhanced Content :: Cross Reference

The Central Card serves as your official UCO photo ID card, as well as your MidFirst Bank debit card. However, if you would like to, you can change your cookie settings at any time. And if you don’t have the right strategy in place, even finding prospects in the first place can be hit or miss. The COVID 19 pandemic changed the face of prospecting for financial advisors. Instead, let prospects experience your talent by, for example, creating a “phantom portfolio” for them, Wharton marketing professor Jonah Berger tells ThinkAdvisor in an interview. Consumers are encouraged to use our online form for complaints. You may be able to deposit more than $250,000 at Bank of the West and still be fully insured by the FDIC. After all, LinkedIn is a networking site first and social media second. Textual Records: Lists of national banks, 1941. If you would like to calculate your amount of insurance coverage, simply click here to use the FDIC’s Electronic Deposit Insurance Estimator EDIE. Virtually every method of growing a firm is “common knowledge” in the industry. Examples may include, business owner, professors, executives, entrepreneurs, or surgeons, to name a few. One way to ease into prospecting is to recreate what has already worked by making a top client chart. Start by connecting with users, starting conversations, and joining groups. It is important to take the right decision for financial stability, better wealth management and reduced business risks. User IDs potentially containing sensitive information will not be saved. Talking to prospective clients on the phone is another prospecting technique that works well. Even if you’ve identified a target market based on an ideal client profile, it’s still a numbers game.